This story was originally written when ICOs were at their APEX and every second entrepreneur I would talk to wanted my help in ICOing. Since then, things have gone south for the ICO industry. So many scammers and bad projects have sullied the waters of what might have been an amazing new industry. But, no worries, a new breed of block-chain based investments have since taken root — the regulated STO, which is a new way of fund-raising that combines the old (better due diligence, better investment stake in the company) with the new (digital assets, liquidity). So, if you are still interested, I suggest reading my blog post about STOs. Otherwise, if ICO (or IEO today) is still your cup of tea — read on.

2017 ended with a bang for startups raising capital using crypto assets. With over $4B raised in 2017 in ICOs every entrepreneur today wants to get in on the action. But what does it really mean to ICO and who is this good for? Before jumping on the ICO bandwagon, you will need to consider: is your venture right for an ICO?

In this article, I will try to show you how to answer this question.

Some Background first

Let’s start with the basics: An Initial Coin Offering (ICO), or a TGE (Token Generating Event) as it is known today, is a process by which a company issues a crypto asset (such as a crypto-coin) and offers individuals the opportunity to purchase those assets when they are first offered (hence “initial offering”). This is essentially a way to raise money for a future product (presell), service (utility), or some asset (security).

An ICO is not a single one-day event. It is an ongoing process that may take several months and is divided into several stages. While there is no official “rule-book” for what to do, several industry standards have been set, and most startups choose to follow these standards.

Is your venture right for an ICO?

Before rushing forward with an ICO, here are several questions to ask yourself to see if the ICO route is right for you and if you are the right company to succeed in an ICO.

Question #1: is blockchain an integral part of my solution?

Since we are about to generate a new coin (or token), the underlying assumption is that this coin is used on a blockchain which is a core component of your company’s product or service. However, in the rush to raise money in an ICO, many companies are artificially adding blockchain to their technology without any real reason or added advantage to them, their customers, or the market.

If you can take your solution and replace blockchain with any regular database and not lose any functionality, economic value, or unique advantage, then you are not using the blockchain properly.

Only use an ICO as a funding tool if your answer is: blockchain solves a real need and is properly used in my solution.

Question #2: Is there an economic advantage to using a token/coin in my solution?

Generally speaking, there are two types of coins – security coins and utility coins. Security coins are generally a means of improving current securitization processes, and utility coins are about creating new economic value.

Therefore, you should really examine if there is logic in issuing a new coin? Are you able to create new value where there is none? Are you able to overcome limitations set by the current economy’s processes? If you can take your solution and replace any mention of your coin with a standard fiat Dollar, or a standard tracking ledger (even an Excel), then you have done nothing of real economic value and should not be creating a new coin.

Only use an ICO as a funding tool if your answer is: my new coin is creating new economic values (utility) or will fundamentally improve on today’s way of handling value (security)

Question #3: Am I in it for the long haul?

ICOs are a new way of funding, and they are changing the way companies operate not only in the short-term but also in the long-term. Essentially, since ICOs are a non-dilutive way of raising money, all the company equity remains in the hands of the founders. That sounds great, but this means that most of the value created by the company will actually be held by the user or investors in the form of the coin.

So here’s the problem -What happens in the case an M&A? to phrase this in startup speak – how can you plan an exit strategy? If before founders knew that at a certain stage they might have the option of selling their shares and exiting the company, it is not exactly clear what will happen with a company that has ICO’d. There are too many questions right now even to know if a company that is operating its own economy can really be purchased by another company and what that involves.

It stands to reason that these issues will be solved, but if you are planning on a quick exit using an ICO, think differently. As a coin holder, you may receive an influx of money, but as part of the company’s core team, you should know that you may be required to be part of the company for a long time.

Only use an ICO as a funding tool if your answer is: I am committed to this company and idea for the long-term.

Question #4: Do I have the team to execute this?

The amazing things about ICOs is that when they succeed the company receives an amazing influx of capital very fast, sometimes tens of millions (sometimes more). However, this means that with money in the bank, the company must execute on their promises very fast. For that, you need an ace team on board. You need to be a company that brings the product to market fast and markets it successfully with a development team that is able to scale fast while maintaining a great user experience.

In addition, since there are so many ICOs out there right now, one of the differentiating factors between all these companies is the strength of the team. If you, or your team, have the track record to show this is not your first rodeo then you will give your investor the confidence you will be able to execute (also the confidence this is not a scam).

Take into consideration that even before the ICO is launched, your team should include positions that are not found in the regular startups – a blockchain expert, a token-economics specialist, a marketing guru with ICO knowledge, a community manager. Find these people and get their help in launching the ICO.

Only use an ICO as a funding tool if your answer is: My team can execute and scale fast, it imbues anyone who hears about them with the confidence that this is the right team for the job, and I have the right people to launch a successful ICO.

Question #5: Do I have the budget?

Finally, do you have the budget to go through this process? This is the question that surprises many entrepreneurs who think that ICOs are an easy thing to execute. Here’s the thing – today there are about 150 new ICOs every week. This number will only grow as long as the regulation does not throttle the market. In order to succeed you need to main things – be prepared fast and stand out above the noise.

Be prepared fast – to launch your ICO you will need to have all your ducks in a row: legal, accounting, and business. Legal means having a top-tier law firm with ICO experience and knowledge consulting you and ensuring you do everything by the books and do not risk a regulatory backlash. Accounting means having an accounting team and a CFO who understand all the tax ramifications of raising money by ICO. Business means having all the answers to the blockchain and token economics as well as your go-to-market and expansion plans – this should be in the form of a white paper (or any other color paper) as well as a very detailed internal business plan and financial model.

Stand out above the noise – once everything is ready, you will go public. Now is the time to put all the efforts on marketing and PR. This means press releases, social network (Reddit, GitHub, facebook) activity, doing a roadshow, and all other actions necessary for ensuring people hear about you. Doing this alone is difficult, and you will probably need a specialized PR and marketing company to help you out.

The problem is that these things cost money. Especially the marketing. And if you don’t have the money to start this process or the means to raise it in pre-sale, you will have a hard time raising substantial funds in the actual ICO.

Only use an ICO as a funding tool if your answer is: I have, or can raise, at least $250,000 for the ICO process (note: frankly $1M-$2M is probably the right number)

To conclude

If you wish to ICO and your solution is blockchain-enabled and creates new economic value, and if you have the team, budget, and stamina for making your vision into a reality, then an ICO may be the right tool for you.

If you are still interested, then contact us today and we will help you ICO!

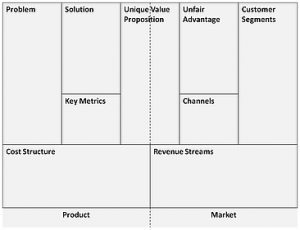

The Lean Canvas is a popular term that everyone is using.

The Lean Canvas is a popular term that everyone is using. If you would put the Israeli entrepreneur’s DNA under a microscope you would find a results-orientated chromosome rather than a process-oriented chromosome. Don’t believe me? Try managing Israeli’s and then lets talk. Israelis thrive under high-pressure deadlines, not under what they consider to be bureaucratic processes.

If you would put the Israeli entrepreneur’s DNA under a microscope you would find a results-orientated chromosome rather than a process-oriented chromosome. Don’t believe me? Try managing Israeli’s and then lets talk. Israelis thrive under high-pressure deadlines, not under what they consider to be bureaucratic processes. One thing:

One thing: