TL;DR – we are facing an economic downturn. Now is the time to incubate new ideas that will emerge from R&D once the market awakens. The people who can invest in the pre-seed stage now will reap the largest rewards after the recession.

The economic downturn is upon us

The COVID-19 pandemic has gone through economies like a tropical storm, leaving havoc behind it. It is not yet clear the extent of the damages, but one thing is clear, it will take the market several years to bounce back. This is even more evident in the world of venture investments, where the term “bubble” was already beginning to pop up since 2018.

We are already starting to see VCs holding back on investments and lowering valuations, and I assume this trend will continue for at least the next year if not for longer. We have yet to fully understand how the results of the enforced social distancing will play out, but it is quite obvious that many businesses will not survive this period, which may start an economic snowball that will drive us into a prolonged recession.

For startups this means harder times are coming and fundraising will be difficult (even more than usual), especially for later stage companies with unclear business models. How bad will it be? It is impossible to know at this time. However, what we can do is examine the last two major downturns – the 2000 dot-com crash and the 2018 financial crisis for clues.

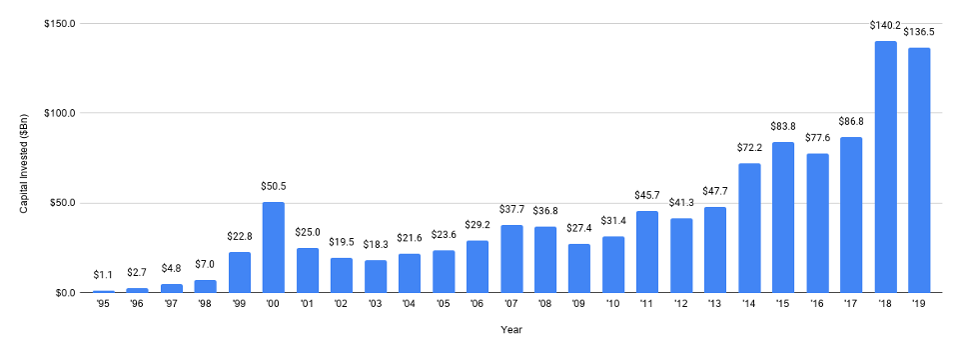

Figure 1: Funds invested in US startups by VC funds

The dot-com crash was directly linked to the over-valuation of startups and it took 3-4 years for the confidence to return to the market. The 2008 financial crisis mostly placed VCs into a holding pattern while they waited to see the effects it will have on the market and within just two years investments returned to their former levels.

I hope that the COVID pandemic crisis is more like the 2008 financial crisis than it is the 2000 dot-com crash, but you never know.

The good news

Downturns are also an opportunity. They (usually) have an end. That end, the period of exiting the recession, is the best time to introduce a new company or product to the market.

I launched my first company in 2003, just as we were getting out of the dot-com recession and the fast growth we experienced (with almost no marketing) was mostly due to the post-recession feeling that was hitting the markets. I have been working as a consultant and investment banker for startups since 2011 and I have seen a post-recession laxness taking hold of VCs in the post-round A funding rounds, something that was difficult to see since late 2008.

But you need to prepare now

However, being able to launch at the end of a recession requires you to be ready. That means finishing all the R&D and having a market-ready product. Luckily, the best time to go into deep R&D mode is during a recession – there is usually an abundance of quality employees, costs are lower, and you will find more openness to experiment from design partners and customers (as long as it doesn’t cost them anything).

So, the real question is, how can you finance your R&D stage during a downturn?

Angels and VCs, this is where you come in

R&D for new startups is usually financed by the pre-seed or seed stage. These are small rounds, often supplemented by government grants, that are performed by high net-worth individuals and small VC funds (known as micro-VCs). The rounds, often up to $1 million, enable these angel investors to attain a respectable stake in the company for relatively little.

The smart angel investor will use the downturn to seek out new opportunities, knowing that at the end of the recession the valuation for his investment will be much higher and he will profit twice – once from the direct investment in the company and a second time from the market upturn.

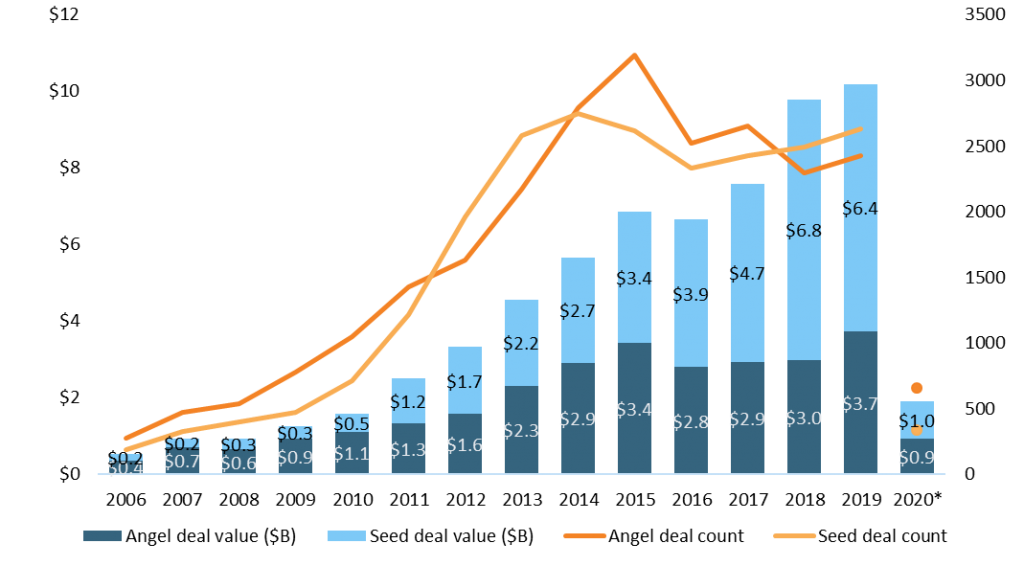

It is no surprise then, that in both previous downturns, seed investments remained steady, while round A and higher rounds declined. It is more apparent after the 2008 financial crisis when angel investing and seed rounds continued to rise.

Figure 2: US angel & seed deal activity (2006-2020)

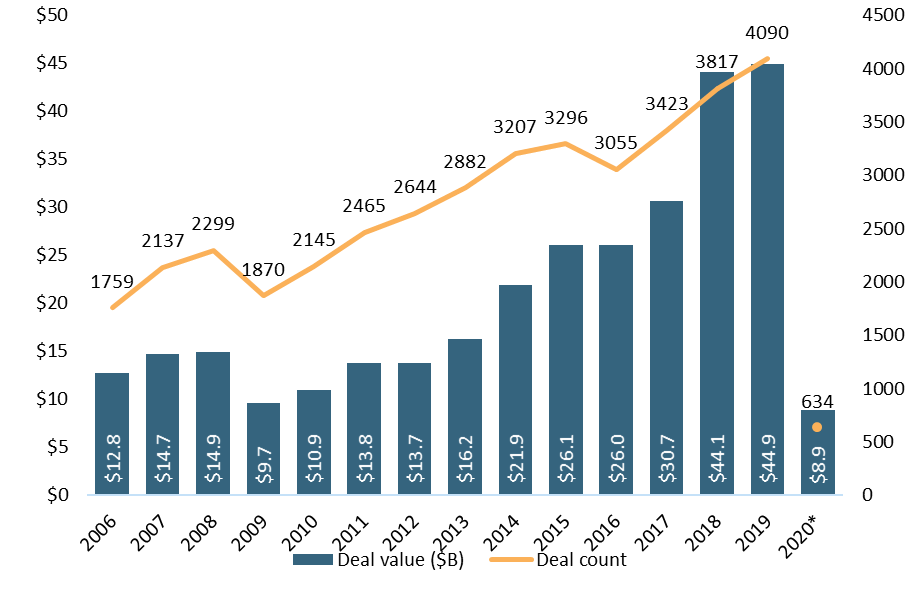

While early-stage (late seed, rounds A and B) investments lagged and began and only started increasing in 2010/11.

Figure 3: US early-stage VC deal activity

Therefore, now is the time to double-down on pre-seed and seed investments. It is important for your portfolio, but it is also important for the economy. If we don’t have enough early-stage companies when the recession starts to end, what will the VCs invest in? And startup founders – don’t hesitate to start your new venture now! Just make sure that the idea itself is viable